The cryptocurrency market is buzzing with renewed vigor, particularly in the staking token sector. As Ethereum (ETH) continues its impressive rally, two major players in the liquid staking and synthetic dollar space, Lido DAO (LDO) and Ethena (ENA), have seen their tokens surge by over 10%. This significant uptick suggests that traders are actively accumulating these assets, recognizing their intrinsic value in a bullish ETH environment.

The Ethereum Effect: Fueling Staking Token Demand

Ethereum’s recent price performance has been a critical catalyst for the broader staking ecosystem. As ETH’s value appreciates, the appeal of staking it to earn yield grows exponentially. Liquid staking protocols like Lido Finance offer a solution that allows users to stake their ETH while retaining liquidity through a derivative token, such as stETH. This mechanism enables participants to earn staking rewards and simultaneously deploy their stETH in other DeFi protocols, maximizing their capital efficiency.

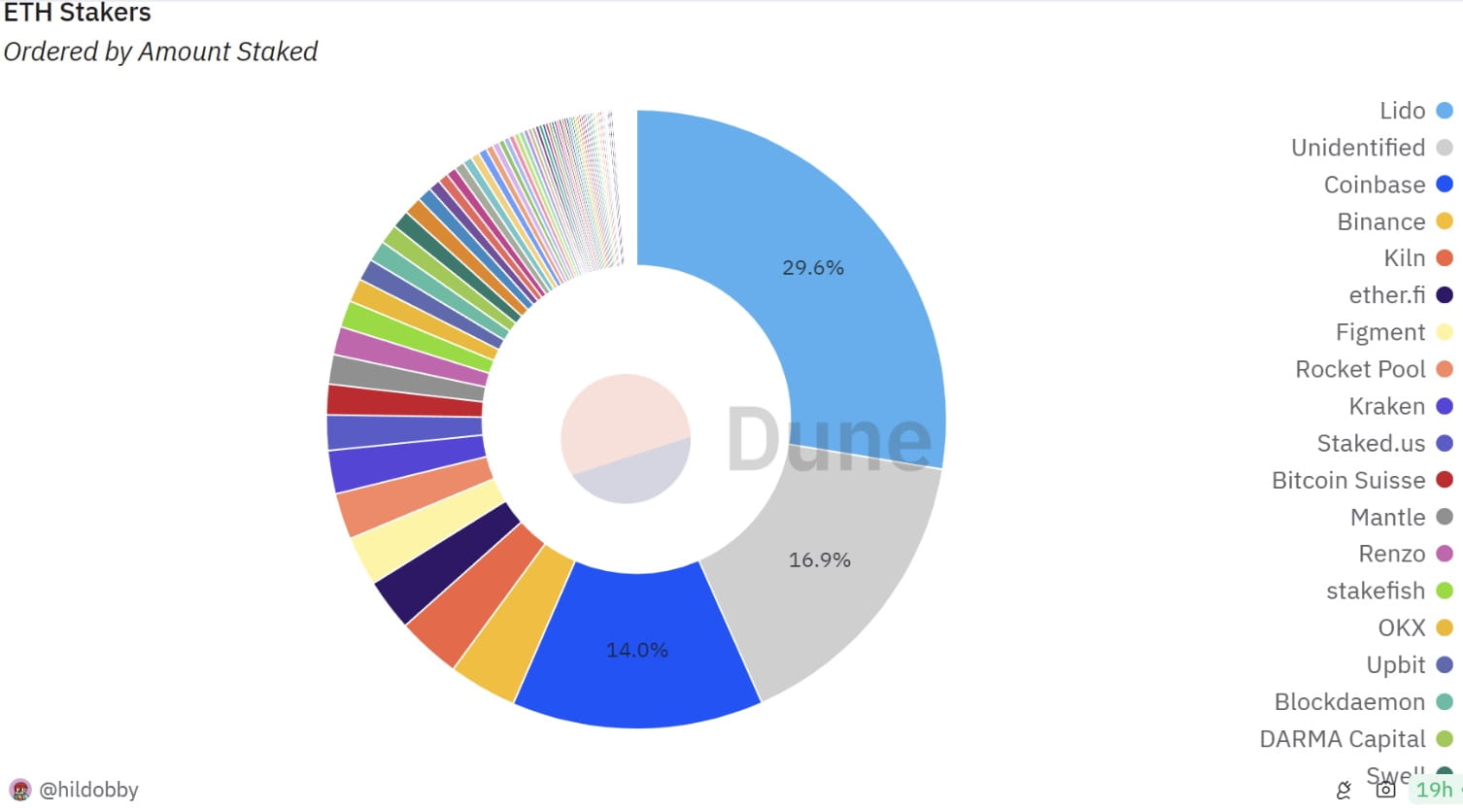

The increased demand for ETH staking directly translates into higher demand for LDO, the governance token of Lido DAO. LDO holders play a crucial role in the protocol’s development and governance, and its value is intrinsically linked to the success and adoption of Lido’s liquid staking services. As more ETH is staked through Lido, the utility and perceived value of LDO naturally increase.

Ethena’s Ascent: A New Paradigm in Synthetic Dollars

Ethena, with its innovative USDe synthetic dollar, has also captured significant market attention. USDe aims to provide a censorship-resistant, scalable, and stable digital asset that is fully backed by staked Ethereum and hedging derivatives. The protocol’s “Internet Bond” concept, which combines yield from staked ETH with funding rates from perpetual futures, offers an attractive yield generation mechanism that has resonated with investors seeking diversified returns.

The surge in ENA, Ethena’s governance token, reflects growing confidence in the protocol’s ability to maintain its peg and deliver sustainable yield. As the broader crypto market matures, the demand for stable, yield-bearing assets like USDe is likely to increase, positioning Ethena as a key player in the evolving digital finance landscape.

Market Insights and Expert Commentary

Industry analysts are closely monitoring these developments. “The correlation between ETH’s performance and the value of staking-related tokens is undeniable,” notes Sarah Chen, a senior analyst at Crypto Insights Group. “As long as Ethereum maintains its upward trajectory, we can expect continued interest and investment in protocols that leverage its staking mechanism.”

Chen further elaborated, “Ethena’s unique approach to synthetic dollars, offering an attractive yield profile, is particularly compelling in the current market. Investors are increasingly seeking alternative yield sources that are less correlated with traditional financial markets, and Ethena fits that bill.”

Historically, periods of strong ETH performance have often preceded or coincided with rallies in its associated ecosystem tokens. This trend is once again playing out, with LDO and ENA serving as prime examples of how underlying asset strength can propagate through the broader crypto market.

Broader Impact on Investors and the Crypto Industry

The recent rallies in LDO and ENA highlight several key trends impacting investors and the wider crypto industry:

- Growing Sophistication of DeFi: The success of protocols like Lido and Ethena demonstrates the increasing sophistication and utility of decentralized finance. These platforms are offering innovative financial products that cater to a diverse range of investor needs.

- Yield Generation Remains Paramount: In a low-interest-rate environment, the attractive yields offered by staking and synthetic dollar protocols continue to draw significant capital into the crypto space.

- Ethereum’s Enduring Influence: Ethereum remains a central pillar of the decentralized ecosystem, and its health and growth are critical drivers for numerous ancillary projects and tokens.

- Risk and Reward Considerations: While the potential for high returns is evident, investors must also be mindful of the inherent risks associated with volatile crypto assets and evolving protocol designs. Due diligence and a clear understanding of the underlying mechanisms are crucial.

Conclusion

The impressive surges in Lido (LDO) and Ethena (ENA) tokens underscore the current dynamism within the cryptocurrency market, particularly in the staking and synthetic dollar sectors. Fueled by Ethereum’s robust performance, traders are actively seeking out opportunities in assets that offer both utility and yield potential. As these protocols continue to innovate and expand their offerings, they are poised to play an increasingly significant role in shaping the future of decentralized finance. Investors and industry participants alike will be closely watching to see how these trends evolve in the coming months, offering a compelling narrative of growth and innovation within the digital asset landscape.