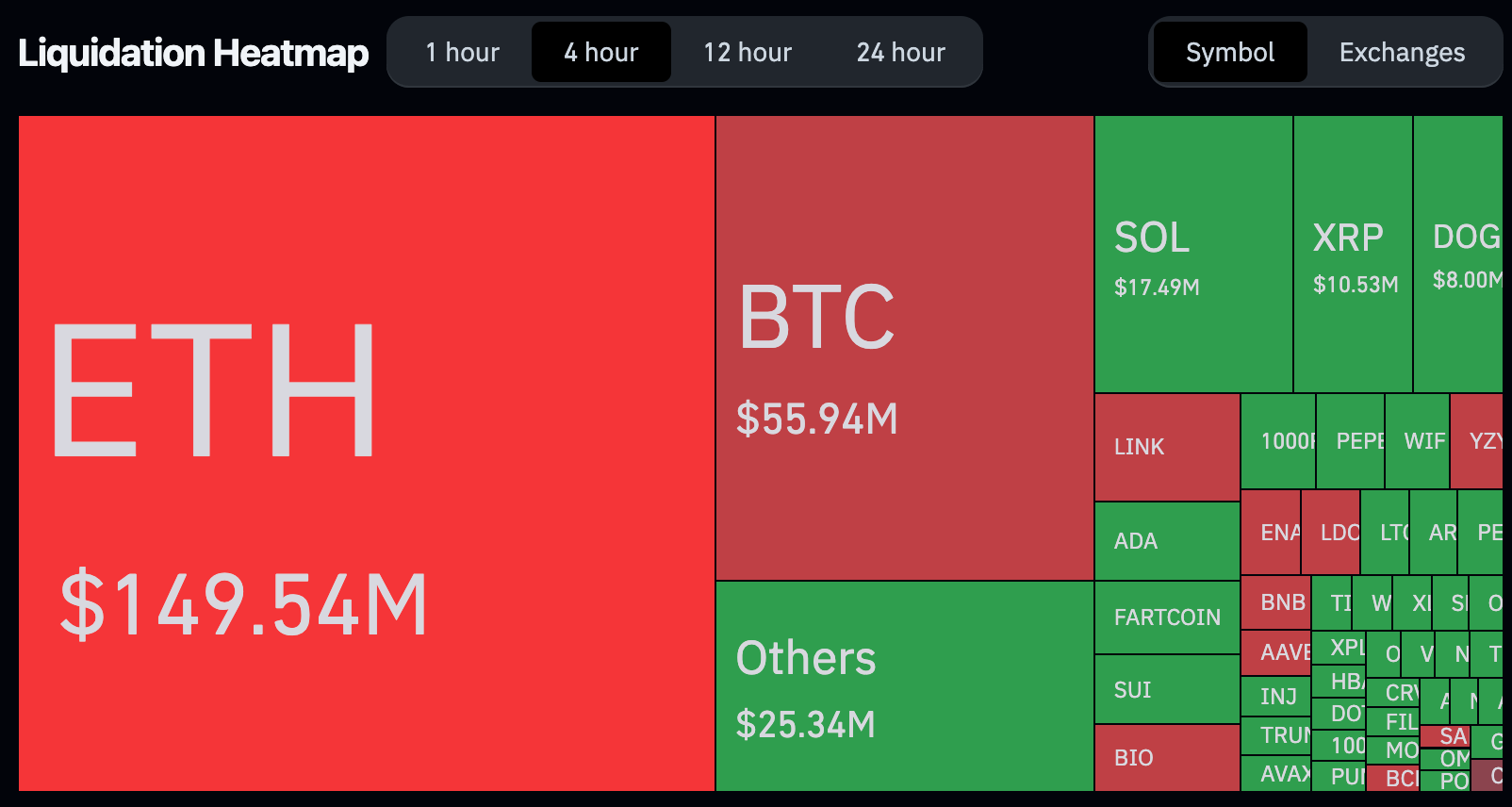

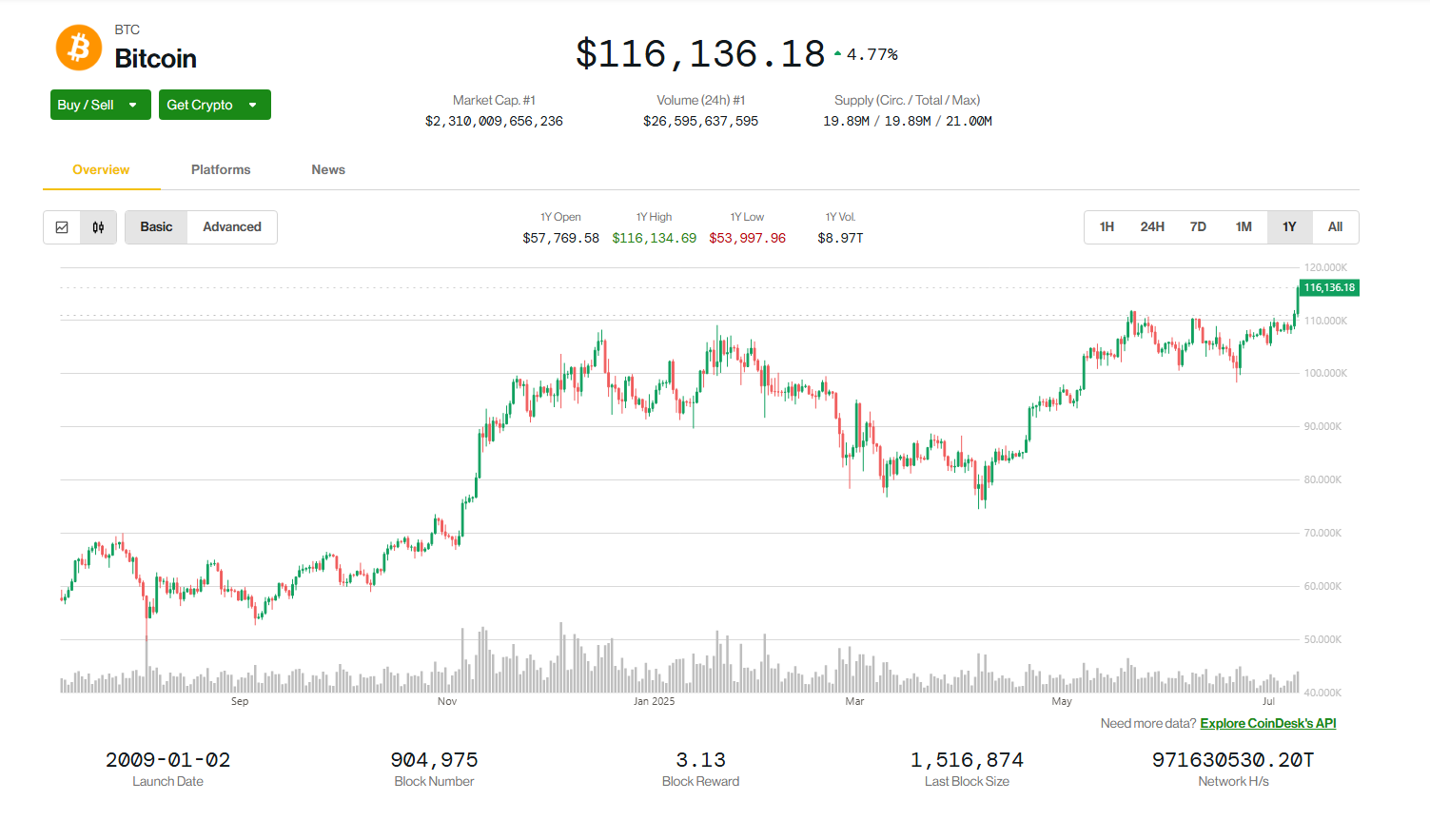

The cryptocurrency market witnessed a dramatic surge in Bitcoin (BTC) and Ethereum (ETH) prices recently, leading to a cascade of liquidations in crypto futures markets. This swift upward movement caught many leveraged traders off guard, resulting in over $375 million in liquidations across various exchanges.

The Bull Run’s Impact on Leveraged Positions

The sudden price appreciation of the two largest cryptocurrencies by market capitalization created significant volatility. Traders holding short positions, betting on a price decline, were particularly vulnerable. As prices climbed rapidly, these positions were automatically closed out by exchanges to prevent further losses, a process known as liquidation. Data from Coinglass indicates that the majority of liquidations were concentrated in short positions, highlighting the market’s strong bullish momentum.

This event underscores the inherent risks associated with leveraged trading in highly volatile markets. While leverage can amplify gains, it can also accelerate losses, as demonstrated by this recent market movement.

Market Dynamics and Investor Sentiment

Several factors are contributing to the current bullish sentiment in the crypto market. The approval of spot Bitcoin ETFs in the United States has opened the door for institutional investment, providing a new avenue for capital inflow. Furthermore, growing anticipation around a potential Ethereum spot ETF has fueled speculation and driven up ETH’s price.

Industry leaders are closely watching these developments. “The influx of institutional capital through ETFs is a game-changer for crypto,” stated Cathie Wood, CEO of ARK Invest, in a recent interview. “It’s validating the asset class and bringing in a new wave of investors.”

Historical Context and Future Outlook

While the recent liquidations might seem significant, such events are not uncommon in the history of cryptocurrency markets. Periods of rapid price appreciation often lead to short squeezes and increased volatility. Historically, these moments have sometimes preceded further upward movements, as overleveraged positions are cleared, paving the way for more sustainable growth.

Looking ahead, the market remains highly dynamic. The continued adoption of blockchain technology, coupled with the potential for further regulatory clarity, could provide a strong foundation for future growth. However, investors and traders should remain cautious, as the crypto market is known for its unpredictable nature.

Broader Implications for Investors and the Industry

The recent events highlight the importance of risk management, especially for those engaging in leveraged trading. For long-term investors, these price fluctuations can be viewed as part of the market’s natural cycle. The underlying fundamentals of Bitcoin and Ethereum, including their growing utility and network effects, continue to attract significant interest.

The crypto industry as a whole is maturing, with increasing institutional participation and a greater focus on regulatory compliance. This evolution could lead to a more stable and robust market in the long run, but it also means that market participants need to stay informed and adapt to changing dynamics.